6 Tax Tips for Independent & Leased Owner Operator Truck Drivers

My name is Dirk Danos and I’m a CPA and Certified Tax Resolution Specialist and my firm specializes in getting Independent & Leased Owner Operators back on track with the IRS.

If you missed filing a return or two, or if you can’t pay what the IRS says you owe, give me a call and lets see what we can do to get it all sorted out. To get started call (504) 835-4213 or click here to send us a message.

Tip #1

Tip #2

Tip #3

Tip #4

Tip #5

Tip #6

If you ever have any issues with the IRS, don’t take them on by yourself! You wouldn’t go to court without an attorney, don’t try to represent yourself to the IRS. We represent hardworking Americans across the country that have fallen on hard times or simply made a mistake filing taxes. We understand that it doesn’t take much for paying taxes to fall way down on the priority list, but if you have a tax problem, and are ready to take care of it, give us a call or fill out the form below! You can also click here to learn more about common tax problems and how to solve them.

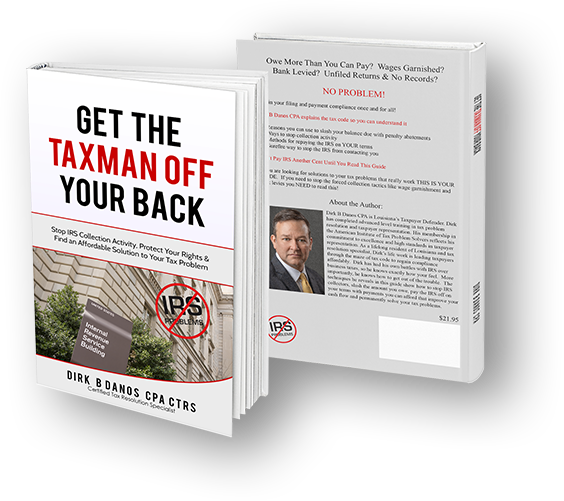

TAX PROBLEM? GET A COPY OF MY BOOK

SEND US A MESSAGE

Have a tax problem or need help with tax preparation or bookkeeping? Send us a message and we’ll be in touch as soon as possible!